November 2020 Colorado Front Range Real Estate Market Update

Hello everyone welcome to my first video/article on Colorado’s real estate Market. As a lot of you may know my real estate partner Matt Shoup and I like to make a lot of content, either for marketing a home that we have listed or even of educational topic related videos. We like to make these videos to get out there and show you guys about real estate and educate you and of course market properties. I’ve been trying to get more content out there and have had more time to make something, so I thought I would go ahead and start with a market update video for November 2020. I know a lot of real estate agents do market updates and they can be a little boring just giving numbers and stats month after month. I’m going to do that, but I also want to tie it in to the real world and see what the numbers mean for Denver and Northern Colorado’s real estate market.

I might be a little bit crazy doing both markets but I do work in the Denver Metro area real estate market as well as the Northern Colorado Front Range market. These are two distinct markets in Colorado. I live down in Denver so I do work the Denver Metro area a lot but I also have my teammate Matt, C3’s headquarters, my office all up in Northern Colorado. So I am up there all the time. I’ll cover both of those markets in this article even though the two markets do generally follow the same patterns. If Denver’s numbers and data or going up or down, generally Northern Colorado’s will also be going the same direction, maybe just not as exaggerated as Denver’s.

The Denver Metro area is going to include multiple counties such as Arapahoe, Boulder, Broomfield, Adams, Clear Creek, Denver, Douglas, Elbert, Gillpin, Jefferson, and Park counties. The Northern Colorado Front Range counties are going to be Boulder, Larimer, Logan, Morgan, and Weld counties as well as Yuma, Washington, Phillips, and Sedgwick.

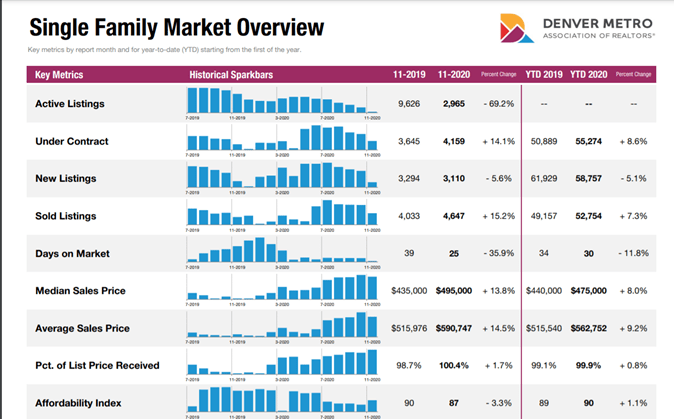

New listings in November for detached single family homes was down 5.6% compared to November of 2019 so not as many new homes coming on the market now as many people listing their homes as this time last year. Under contract and pending homes, so homes that had an offer put on it and are expected to close. Those homes were up 14.1% this year compared to November last year. Closed homes were up 15.2%. Median sales price was up 13.8% at a median sales price of $495,000. The average is up 14.5% at $590,747. Days on market is down 35.9% which means homes are getting listed and staying listed on the market for less time than in November of last year. Average days on market is 25 days.

If you look at the Northern Colorado Front Range market, it’s going the same direction for the most part with the median sales price for northern Front Range is $436,000 and an average of $534,000. Days on market is also down at an average of 58 days.

Not that many new listings coming on the market this year compared to last year. With a market that already has a very low inventory, when you add COVID and the winter months coming up you’re having an even smaller inventory pool with less days on the market because the buyers are out there and it’s competitive.

Showing time is a software that agents across the country use to set up their showing appointments for homes. Showing time gathers a lot of really good data and we can see that showing activity remains higher right now than this time a year ago, across most of the country. This suggests that a strong buyer demand is likely to continue into the typically slowest time of the year. With inventory remaining constrained in most parts of the country, sellers continue to benefit from these tight market conditions. According to Bloomberg, between the months of April to October of 2020, Denver was ranked #8 on the most moved to city during the coronavirus pandemic. That is based off of zip code changes of 174 million LinkedIn members. So yes, demand is really high right now.

With Covid, the winter months coming up, and the Holidays, you already have that low inventory, you could imagine how competitive it is out there looking for a home. As a buyer you need to have a competitive offer in order to compete in this environment. There are some things you might want to think about in order to provide that kind of offer that’s going to be accepted. One strategy is offering to pay more of the seller fees. Those fees can really add up. Owners extended coverage is one of those fees. (if you don’t w what some of these things are that I mention in this article, feel free to reach out to me, I’d love to help explain a little bit more detail anything that I talked about in this video.) Offer to pay for owners extended coverage, seller transfer of title fees, and even the closing services fee which is usually split 50/50 between the buyer and seller. These fees add up and it could be the difference between a winning offer and a losing offer.

One of the most important things you can do is to have your loan ready to go. Sellers are going to be wanting offers from buyers that are serious about buying. If you have your loan wrapped up and ready to go and you know what you qualify for, sellers re going to see that when you send an offer and it’ll show how serious you are. Have your lender letter ready to go and send that with your offer. This could be the difference between your offer and another.

On the seller side of things, as winter and the holiday season approaches, a lot of sellers are deciding to wait until the spring to list their home or withdrawing their home from the market until the Holidays are over. Here are some good reasons why you might want to sell now or not pull your house off the market right away. There are tons of active buyers out right now and with historically low interest rates, those buyers have more purchasing power. You might ask yourself, who’s crazy enough to buy a home in the winter or over the Holidays? The answer is the serious buyers. The ones that are wanting to buy, ready to buy and are serious about buying, those other ones that are looking right now. Another great part about selling in the winner is the holiday decorations. People love holiday decorations. When they go into your home and it feels cozy, they can imagine themselves, and their family eating dinner and spending time with each other. And you know it just looks good. It’s a great marketing strategy and people love it. Again, demand is surpassing supply, so that means you’re in the driver seat, and that is never a bad thing.

Talking about historically low interest rates, rates have remained very resilient even with all these economic headwinds coming their way. Comparing to last week (week of December 13th) 30 year fixed mortgage rate increase just .01% on a year to date basis. That rate is still 1.37% higher than it was in the opening of 2020. The housing market continues to surge higher and support an otherwise stagnant economy that has lost its momentum over the last couple of months. These consistent low rates are keeping the buyers out there looking for homes and it doesn’t appear to be changing anytime soon. In their weekly applications survey the Mortgage Bankers Association had this to say, “the ongoing strength in the housing market has carried into December. Applications to buy a home increased for the fourth time in five weeks as both conventional and government segments of the market saw gains. Government purchase applications rose for the sixth straight week to the highest level since June – perhaps a sign that mor first-time buyers are entering the market.” This just goes to show that demand is still out there that’s not going away anytime soon.

Looking at data, jobless claims has jumped to their highest level in three months. Likely putting additional pressures on Washington to get their stimulus deal done sooner. Retail sales fell for a second straight month and missed expectations significantly. On a happier note, the housing market continues to drive the US economic growth. Housing starts and building permits both beat forecasts and pointed towards relief in some inventory strapped markets. Closing out the year, sounds like things are slowing down a little. Demand is still surging though and that’s not going to change any time soon. Going into 2021, inventory is low and once the spring in the winter months are over and we get through these Holidays, we should see things start changing and we get some more people out there selling their homes and providing more homes for people to move to.

I really appreciate you guys watching this video and reading this article. I hope to do more of these, and hopefully I provided some knowledge to you guys. My hope is to provide you guys value anyway I can. feel free to reach out and let me know if there’s anything you want me to cover or talk about. If you have any questions please contact me personally, I’d love to answer or talk you through any questions you have about real estate, the market, or if you just want to call and chat, let me know I’d love to talk to you. I hope you guys have a great Christmas, great new year, happy Holidays, and I look forward to seeing you all in 2021 thanks